FootPrint Pro ™

For full screen, click

The footprint order flow indicator helps to give an edge to all sorts of traders, whether it be day traders or swing traders. It does this by providing a deep insight in each bars buying and selling activity that is not normally seen.

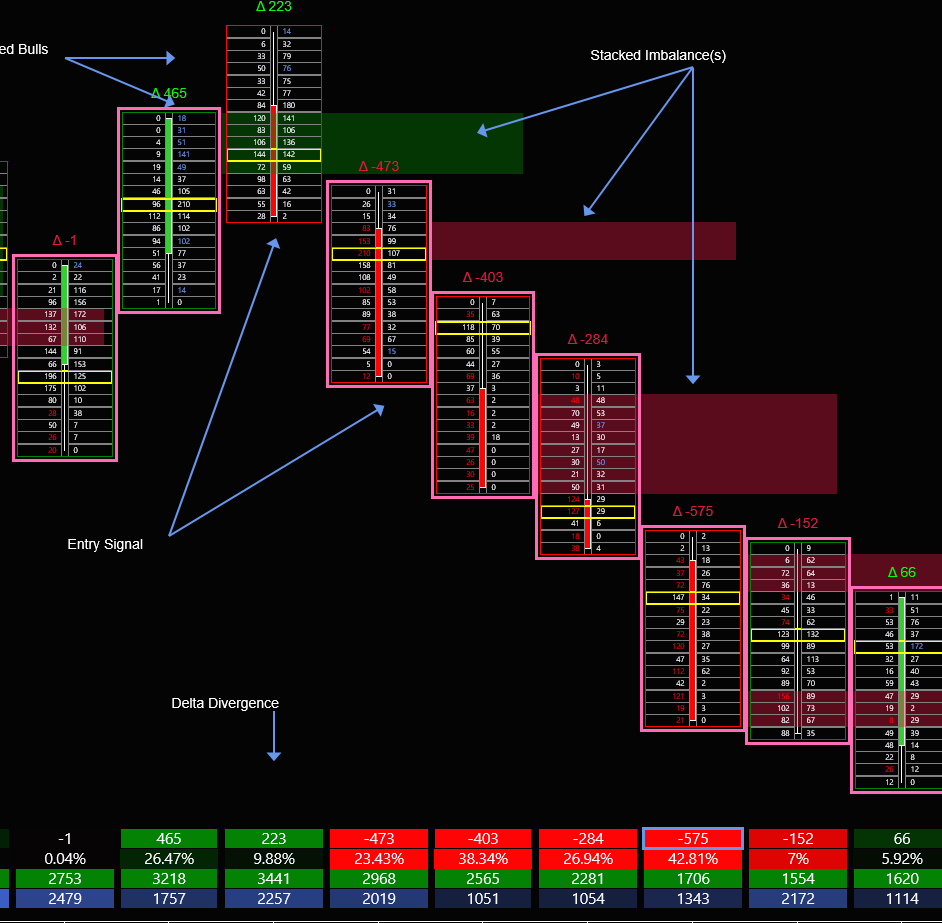

You will be able to see where aggressive buyers and sellers are entering the market. By using this information you'll be able to gain insight over traders who do not have access to this information. Not only will you be able to gain an insight, you'll also be able to clearly see imbalances, stacked imbalances, delta divergence and much more.

Using an order flow chart will help traders pin point when and where to enter the market and when and where aggressive buyers and sellers are entering the market.

The footprint order flow chart helps traders understand why the market is moving and gives them the tools they need to fine tune their entries and exits.

FootPrint Bar Statistics

All the information below can be displayed on top of the footprint bar and turned on/off.

Delta Volume:

Delta Volume is displayed on the first line of the bar statistics. This information is color matched; a seller dominated bar is displayed with a red color and is a negative number whereas a buyer dominated bar is displayed with a green color and a positive number. Delta volume is defined as the bid volume minus the ask volume.

Delta Volume Percentage:

On the second line of the bar statistics delta volume is displayed in a percentage. The delta volume is defined by the delta volume divided by the total volume.

Total Volume:

Line three, the total volume of that bar is displayed. Example, ∑ 7350.

Total Bid/Ask Volume:

Line four, the total BID/ASK volume is displayed. Example 2332/2594.

For full screen, click

For full screen, click

Imbalances

An imbalance occurs when the exchange receives more bids than asks or more asks then bids. Traders are able to use these imbalances to their advantage and use them for entry/exit signals.

Single Imbalances:

A single Imbalance on the bid side of the footprint bar is highlighted red. A single imbalance on the ask side is highlighted blue. These colors are able to be customized to the traders desired color.

Stacked Imbalances:

A stacked imbalance is when multiple imbalances are stacked on top of each other. When this happens the trader has a few options on how he/she would like to display this information.

Standard View/Multiple Imbalances:

With the standard view traders will see bids highlighted red and offers highlighted blue. Additionally, the bar will be highlighted pink, the color of the highlighted bar and the highlighted bids/ask imbalances are completely customizable.

Point Of Control ( POC )

Point of control is the price level at which the greatest number of contracts have been traded within the footprint bar. This level is highlighted yellow and is able to be customizable and toggled on/off.

For full screen, click

For full screen, click

Footprint Summary:

At the bottom of the chart, traders have the option to utilize the summary setting. This summary setting will show the following for each bar:

•Delta

•Delta%

•Volume

•Cumulative Delta

•Min Delta

•Max Delta

This information can help traders pinpoint when and where to enter and exit trades.

Delta Alert:

On the Footprint summary traders have the option to set delta alert levels and hear an audible alert. nce the alert is sounded the delta level will be highlighted blue.

Entry Signal Examples

Gorilla Futures Vs Competitors

FootPrint Pro ™ VS Competitors | GF Footprint | NinjaTrader 8 | OrderFlow Labs | Voltfort Ultimate |

|---|---|---|---|---|

Price | $189.99 Lifetime | $1,099 Lifetime | $300/Month | $199/Month |

Shows Imbalances | Yes | Yes | Yes | No |

Adjustable Tick Levels | Yes | Yes | No | Yes |

Delta Alerts | Yes | No | No | No |

Fully Customizable | Yes | No | No | Yes |

Performance Impact ( x64, 8GB RAM ) | 13% | 15% | 30% | 40% |